Stripe Payment Solutions: A Deep Dive

By

ChicMic Studios

10:37 am

Stripe, Inc. is an Irish transnational fiscal service and software service company headquartered in Dublin, Ireland. The company primarily offers payment-processing software and operation programming interfaces for e-commerce websites and mobile operations. Stripe has become immensely popular among developers for a multitude of reasons. One of its most honored strengths is its inventor-friendly API, designed with clarity and simplicity, creating a smoother development experience. This is rounded by its quick integration capabilities, allowing businesses to set up and begin recycling payments quickly. In addition, Stripe provides comprehensive attestation that’s detailed yet easy to understand, making it a go-to resource for inventors of all situations. Another advantage is its support for multiple programming languages, which means that anyhow of the tech mound an inventor is comfortable with, Stripe can seamlessly fit in.

On the security front, Stripe ensures top-notch measures are in place, ensuring that deals are smooth and secure. As businesses grow, they need systems that gauge with them, and Stripe’s scalable structure is complete at handling growing sales volumes. Also, it’s not just about recycling payments; Stripe offers a point-rich platform equipped with tools for subscriptions, invoicing, and more. With its global reach, Stripe facilitates deals in multitudinous countries and currencies, feeding a worldwide clientele. Even its transparent pricing structure ensures that businesses are well-apprehensive of their charges, fostering trust and trustability. All these factors combined make Stripe a favored choice for numerous inventors across the globe.

Payment methods

Stripe supports various payment methods to cater to the global audience. Here are some of the primary payment methods and instruments supported by Stripe:

- Credit and Debit Cards: These include major international card networks such as Visa, Mastercard, American Express, Discover, JCB, and others.

- Digital Wallets: Stripe supports popular digital wallets like Apple Pay, Google Pay, and Microsoft Pay.

- ACH: For US bank accounts, Stripe supports Automated Clearing House (ACH) transfers.

- SEPA Direct Debit: For European customers, the Single Euro Payments Area (SEPA) Direct Debit is supported.

- Bank Transfers: Stripe supports localized bank transfer methods, such as FPX in Malaysia or Bacs Direct Debit in the UK.

- Local Cards and Payment Methods: This includes practices like iDEAL in the Netherlands, Bancontact in Belgium, Giropay in Germany, and others specific to certain regions or countries.

- Apple Pay, Google Pay, Alipay, and WeChat Pay: Stripe supports these platforms for businesses aiming to tap into the market.

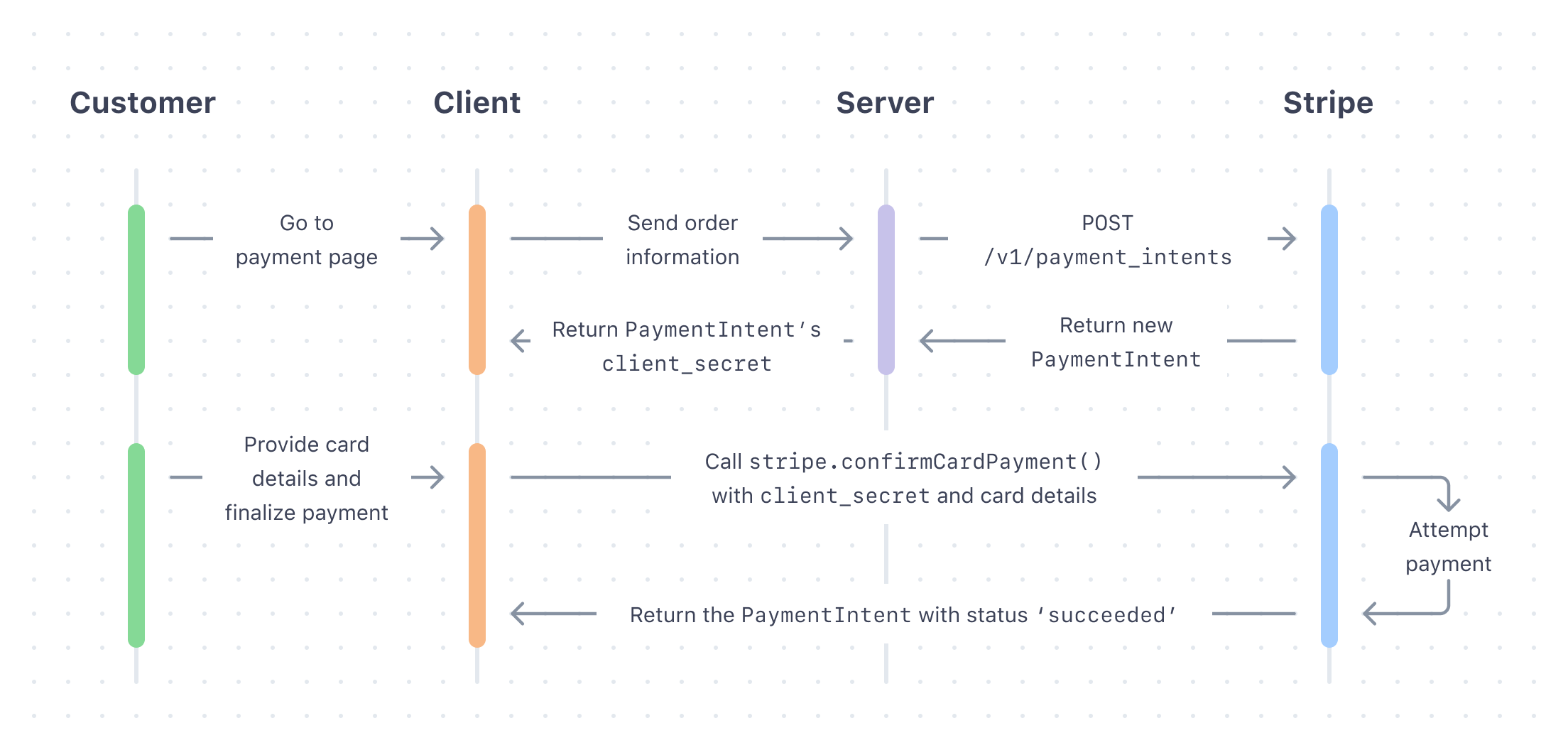

One time payments

A PaymentIntent helps you through the process of collecting a payment from your client. We recommend producing exactly one PaymentIntent for each order or client session in your system. You can source the PaymentIntent later to see the history of payment attempts for a particular session. A PaymentIntent transitions through multiple statuses throughout its operation as it interfaces with Stripe.js to perform authentication overflows and eventually create, at most, one successful charge.

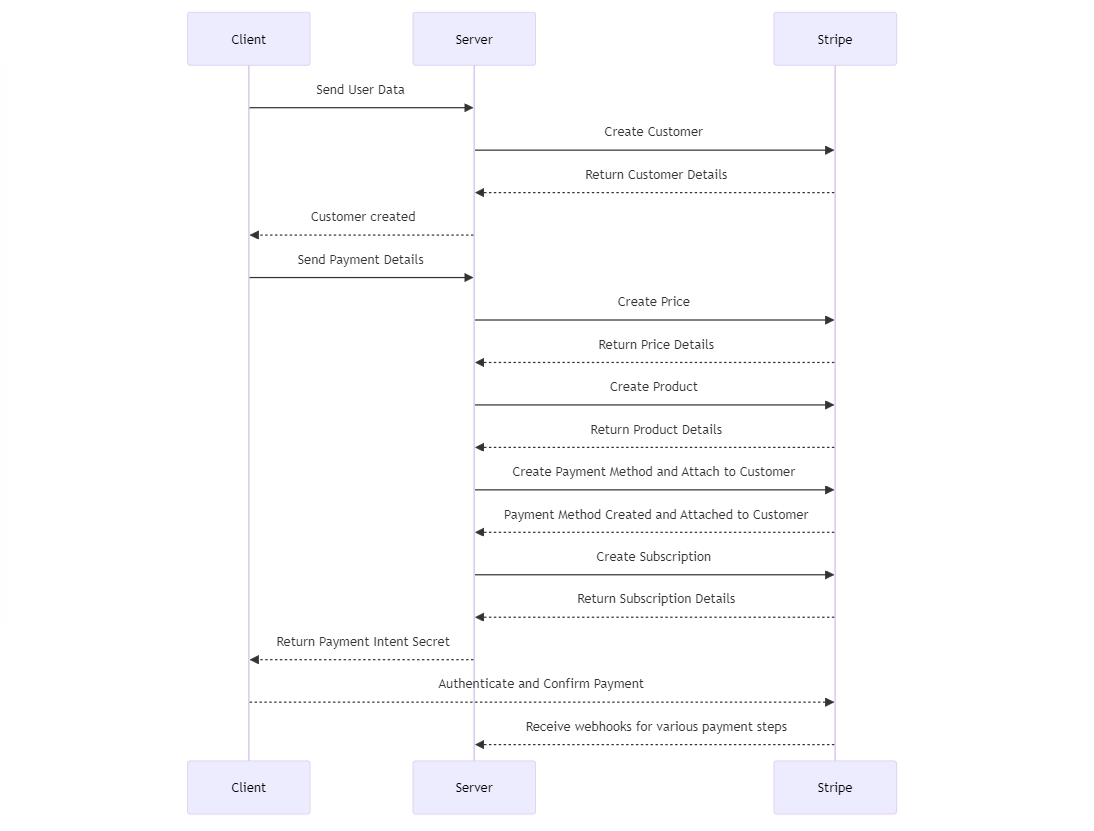

Recurring payments

Subscriptions represent a business model where clients commit to making regular, recreating payments in exchange for uninterrupted access to a product or service. Compared to one-time purchases, managing subscriptions demands a deeper understanding and retention of client information. This is primarily because the billing process is ongoing and may involve multiple deals over an extended period. To achieve this, Stripe has an essential medium where setting up subscriptions necessitates the creation of a devoted client account. Formerly established, this account acts as a depository, securely storing vital client data and payment details. This streamlined approach not only ensures that billings are conducted seamlessly but also enhances the stoner experience by barring the need for guests to input their payment information constantly. Using Stripe’s robust subscription structure, businesses can offer a more individualized and hassle-free payment trip to their clientele, fostering trust and encouraging long-term client connections.

Stripe webhooks

To seamlessly integrate the Stripe payment system on the backend, it’s imperative to employ a combination of Stripe’s APIs and webhooks. While the APIs facilitate direct interactions such as payment processing and customer data management, the webhooks play a crucial role in receiving real-time updates from Stripe about various events, ensuring that our backend remains synchronized with any changes or transactions occurring on the Stripe platform. This dual implementation provides a robust and responsive payment infrastructure for our application.

Charges and balance transaction

Charge: At its core, a charge signifies an effort to deduct a specific sum from a customer’s chosen payment method, be it a credit card, digital wallet, or another payment avenue. Beyond the basic transaction amount and currency, a charge encompasses many attributes. This includes its current status (whether it’s successful, pending, or failed), details about the payment method utilized, a note that provides context about the transaction, and an email for sending receipts, among other attributes. Each charge, therefore, provides a comprehensive snapshot of a single transaction attempt.

Balance Transaction: Moving beyond individual transaction attempts, the balance transaction plays a pivotal role in clarifying the financial status of a Stripe account. Think of it as a ledger entry that captures every nuance that impacts the account balance. This includes not just charges but also refunds, transfers, and, crucially, any associated fees. The balance transaction is essential for anyone keen on decoding their Stripe account’s complexities. It provides insights into the funds ready for payout and offers a detailed trail of every financial movement, ensuring transparency.

Furthermore, it’s crucial to understand the relation between PaymentIntents and these terms. When a PaymentIntent – which signifies an intention to collect payment – is executed successfully, it generates a charge at the end. Correspondingly, for every charge that emerges from a successful PaymentIntent, a balance transaction entry is simultaneously logged. This system ensures a meticulous record-keeping of all financial activities, allowing users to maintain clarity and control over their Stripe accounts.

Integrating withdrawals

Users must first complete a specific setup to withdraw money from Stripe, which mainly involves opening a Stripe Connect account. A sophisticated framework called Stripe Connect was created to support complicated payment models, such as those involving several parties. In other words, payments cannot be accepted, and money cannot be transferred to a user’s bank account without a Connect account. This is because the Connect account serves two purposes within the Stripe API ecosystem: it facilitates transaction flow and represents your users. This is very important, particularly in terms of security and compliance. Stripe creates linked accounts to collect and compile essential data, guaranteeing that each user’s identity is fully validated before any transaction occurs.

Should Your Business Use Stripe?

If you don’t have a payment gateway, you’ll need to build a technical stack and an in-house payment system. The whole process is time-consuming, resource-intensive, and will need around the clock management. Adopting Stripe for your online transactions eases all the above hassles and allows you to exploit market opportunities.

Large enterprises like Shopify and Amazon rely on Stripe as their payment gateway since it offers great security and developmental tools. Some of the advantages it offers are:

-Business operations: Stripe allows finance and revenue automation to boost growth, increase efficiency, and reduce costs. It also offers roles and permission assignments among team members to ensure data protection.

-Third-party integrations: You can use prebuilt integrations to extend Stripe’s capabilities to suit your business needs. The team continuously adds tools and products that work with Stripe.

-Insights and reports: You can use SQL to easily analyze your Stripe data, study insights and build custom reports from the dashboard itself. It also shows customer data, plans, balances, can initiate refunds, manage disputes, and review fraudulent charges.

Concluding note

Stripe proves to be an excellent choice if you have an e-commerce sales stream and seek a tech-heavy gateway with strong security. It enables businesses to create their online payment ecosystem using its services and developer tools. Stripe supports various payment options that include credit, debit, mobile, etc. The subscription system allows you to offer personalized payment journeys to your clients.